Unlocking Compounding Growth in Australian Property

Introduction

Investing in Australian property offers a unique avenue for wealth accumulation. Central to this is compounding growth, a powerful force in real estate investment.

Understanding the power of compounding growth is crucial if you’re navigating the dynamic Australian property market. Especially for those looking to invest in areas like the Central Coast, the expertise of a buyers agent can be invaluable. This article will help you uncover the potential of compounding growth and the pivotal role played by Central Coast buyers agents in maximising your investment.

In this article, you will learn:

- The dynamics of compounding growth in the Australian property market.

- A Central Coast buyer agent can be a game-changer in your investment journey.

- Practical strategies for capitalising on the power of compounding growth in real estate.

Let’s dive into the world of property investment and explore how to make your assets work for you.

Understanding Compounding Growth in Property Investment

Compounding growth in real estate investment is a powerful concept, often likened to the snowball effect. It’s where the value of your property investment grows exponentially over time, not just from the initial price appreciation but through the continuous accumulation of value year after year. This growth is particularly pronounced in the Australian property market, renowned for its long-term stability and consistent appreciation rates.

In Australia, the property market has shown a remarkable capacity for sustained growth. This isn’t merely due to economic stability; factors like population growth, urban development, and infrastructural advancements influence it. These elements collectively contribute to the escalating value of property, making it a fertile ground for compounding growth.

The principle of compounding in property investment is straightforward yet profound. When a property appreciates, this increased value compounds over time. For instance, a 5% annual increase in property value may seem modest in the first year. However, as each year’s growth builds upon the last, the overall increase in value can be substantial over a decade or more. This is not just growth on the initial investment but growth upon growth – the essence of compounding.

The compounding effect can be even more pronounced in areas like the Central Coast, where property demand and growth have been historically strong. The allure of coastal living and the area’s evolving infrastructure and lifestyle amenities make it ideal for property investors. Here, the compounding growth isn’t just a figure on paper; it’s a tangible increase in wealth, seen in the rising property values and the growing demand for real estate.

But why is the Australian market particularly suited for compounding growth in property investment? Several factors come into play. Australia’s robust economic position, stable political climate, and consistent population growth, driven by natural increase and immigration, perpetually fuel the demand for housing. This demand, coupled with limited land supply in sought-after areas like major cities and coastal regions, naturally drives up property values.

In summary, the power of compounding growth in Australian property investment is not just a matter of market speculation; it’s a well-observed phenomenon backed by decades of market data. It’s why savvy investors look to the Australian property market for long-term wealth generation, and it’s a fundamental concept that every prospective property investor should understand.

Scenario Analysis: Comparing Different Growth Rates

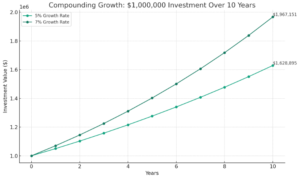

Understanding the impact of different compounding growth rates is crucial in property investment. Let’s compare two scenarios to illustrate this: investing $1,000,000 in a property with a 5% annual growth rate versus the same amount in a property with a 7% growth rate.

In the first scenario, a $1,000,000 investment with a 5% annual growth rate shows a steady increase in value. For instance, the property would be worth $1,050,000 after the first year. The following year, it grows on this new value, becoming $1,102,500, and so on. Over 10 years, this compounding effect significantly escalates the property’s value.

In contrast, a 7% growth rate accelerates the compounding effect even more. The same $1,000,000 investment would grow to $1,070,000 in the first year. By the second year, it’s growing from the original million to $1,070,000, making its value $1,144,900. This steeper growth rate substantially increases the property’s value over the same period.

The Graph below illustrating these two scenarios vividly demonstrate the power of a higher compounding rate. While a 2% difference might seem minor on paper, the compounded results over several years can be strikingly different. The graph will show that while both investments grow over time, the property with the 7% growth rate will amass a significantly larger value by the end of the 10 years.

This analysis highlights the importance of choosing properties with higher growth potential. It also underscores the value of expert advice from a Central Coast buyers agent, who can help identify properties with the best growth prospects.

The Role of Central Coast Buyers Agents

Central Coast buyers agents are more than just intermediaries in property transactions; they are pivotal in maximising the potential of your investment. Their role extends beyond finding a suitable property; they provide expert guidance and insights to identify properties with the highest potential for compounding growth.

These professionals bring a wealth of local knowledge, including insights into market trends, property valuations, and future development plans in the Central Coast region. This expertise is invaluable in pinpointing properties that are not only poised for immediate value appreciation but also for sustained growth over the years. A savvy buyers agent can identify hidden gems – properties in areas likely to experience significant growth due to factors like upcoming infrastructure projects or demographic shifts.

Moreover, Central Coast buyers agents have an intricate understanding of the nuances of the local real estate market. They can navigate complex negotiations, ensuring you get the best possible deal. This includes assessing fair market value, understanding zoning laws, and predicting future market shifts. Their negotiation skills can make a significant difference in the initial purchase price, subsequently affecting the compounding growth trajectory of the investment.

A Central Coast buyers agent is a strategic partner in your investment journey. They help you make informed decisions, minimise risks, and maximise returns. Their role is especially critical for investors looking to capitalise on the power of compounding growth, as they provide the insights and expertise needed to make strategic, long-term investment choices.

Strategies for Maximising Compounding Growth

Investors need to employ strategic approaches to capitalise on the power of compounding growth in real estate. Here are key strategies that can help enhance the compounding effect on your property investments:

Strategic Property Selection:

-

- Focus on locations with high growth potential, like emerging suburbs or areas undergoing redevelopment.

- Utilise the expertise of a Central Coast buyers agent to identify properties that are likely to appreciate at a higher rate.

Long-Term Investment Mindset:

-

- Property investment should be viewed as a long-term endeavour. Short-term market fluctuations are less significant compared to long-term compounding growth.

- Patience is key. The most significant gains often come from holding onto properties over extended periods.

Leveraging Market Cycles:

-

- Understanding and leveraging property market cycles can significantly impact investment returns.

- Engage a buyers agent to help navigate these cycles and make informed decisions on when to buy or sell.

Value-Add Opportunities:

-

- Look for properties that offer opportunities for value addition, such as renovations or developments, which can accelerate growth.

- A buyers agent can advise on properties with untapped potential and guide on how to maximise their value.

Diversification:

-

- Diversify your property portfolio across different types of properties and locations to spread risk.

- A diverse portfolio can provide more stable growth as other markets may peak at other times.

Implementing these strategies, especially with the guidance of a knowledgeable Central Coast buyers agent, can significantly enhance the potential for compounding growth in your property investments.

The Long-Term Benefits of Investing in Australian Property

Investing in Australian property is not just about immediate gains; it’s about understanding and capitalising on the long-term benefits of compounding growth. Here are key reasons why Australian property remains an attractive long-term investment:

Stable Market Growth:

-

- Australia’s property market has a track record of stable and consistent growth, offering investors a sense of security and predictability in their investments.

- Unlike more volatile investment options, property in Australia typically experiences steady appreciation, making it a reliable asset for long-term growth.

Demand and Supply Dynamics:

-

- Australia’s growing population and urbanisation trends continually fuel demand for housing, particularly in high-growth areas like the Central Coast.

- Limited land availability in desirable areas further enhances property value over time, contributing to the compounding effect.

Hedge Against Inflation:

-

- Real estate is often considered a good hedge against inflation. As living costs rise, so does property value, preserving and enhancing the real value of your investment over time.

- This aspect makes property investment appealing to those seeking to protect their wealth against inflation.

Rental Yield and Passive Income:

-

- In addition to capital growth, property investment can provide a steady stream of rental income, contributing to its attractiveness as a long-term investment.

Legacy and Wealth Building:

-

- Property is a tangible asset that can be passed down through generations, offering a way to build and preserve wealth for the future.

- Investing in Australian property is not just about individual financial gain; it’s about creating a lasting legacy and financial security for future generations.

The enduring appeal of Australian property investment lies in these long-term benefits, underpinned by the power of compounding growth. It’s a strategy that requires foresight, patience, and expert guidance, particularly from knowledgeable professionals like Central Coast buyers agents.

Conclusion

The journey through the intricacies of compounding growth in Australian property investment reveals several vital insights:

- Compounding growth transforms property investment from a mere transaction into a powerful tool for wealth accumulation. Understanding and leveraging this principle is vital to maximising your returns.

- Central Coast buyer’s agents play an instrumental role in this process. Their expertise and local knowledge can significantly influence the success of your investment, helping you choose properties with the best potential for compounding growth.

- Implementing strategic investment approaches, such as focusing on high-growth areas, leveraging market cycles, and seeking value-add opportunities, can amplify the effects of compounding growth.

As we’ve seen, investing in Australian property is not just about the immediate returns. It’s about the long-term benefits – stable market growth, protection against inflation, and the potential for passive income and legacy building. This investment strategy, guided by the expertise of a skilled Central Coast buyers agent, can lead to substantial financial rewards and security.

If you’re inspired by the potential of compounding growth in property investment, the next natural step is to consult with a Central Coast buyers agent. They can provide personalised advice and help you navigate the complexities of the property market, ensuring your investment journey is both profitable and rewarding.